CBSE Question Papers Class 12 Economics 2019

Time allowed : 3 hours

Maximum marks: 80

CBSE Question Papers Class 12 Economics 2019 Set – I

Section – A

(MICROECONOMICS)

Question 1.

The Total Revenue earned by selling 20 units is ₹ 700. Marginal Revenue earned by selling 21st unit is ₹ 70. The value of Total Revenue

earned by selling total 21 units will be (Choose the correct alternative)

(a) ₹ 721

(b) ₹ 630

(c) ₹ 770

(d) ₹ 720

Answer:

(c) ₹ 770

Question 2.

In the given figure \(X_1Y_1\) and \(X_2Y_2\) are Production Possibility Curves in two different periods \(T_1\) and \(T_2\) respectively for Good X and Good Y. \(A_1\) and \(A_2\) represent actual outputs and \(P_1\) and \(P_2\) represent potential outputs respectively in the two time periods.

The change in actual output of Goods X and Y over the two periods would be represented by movement from (Fill up the blank)

(a) \(A_2\) to \(P_2\)

(b) \(A_1\)to \(P_2\)

(c) \(P_1\) to \(A_2\)

(d) \(A_1\) to \(A_2\)

OR

The Marginal Rate of Transformation (MRT) is constant. The Production Possibility Curve, so formed would be ………… to the origin. (Fill up the blank)

Answer:

(d) \(A_1\) to \(A_2\)

OR

Straight line

Question 3.

Under imperfect competition, Average Revenue (AR) remains ………… Marginal Revenue (MR). (Fill up the blank)

OR

For a firm to be in equilibrium, Marginal Revenue (MR) and Marginal Cost (MC) must be …………… and beyond that level of output Marginal Cost must be …………. ” (Fill up the blank)

Answer:

Greater than

OR

Equal, rising

Question 4.

If the supply curve is a straight line parallel to the vertical axis (Y-axis), supply of the good is called as ……………. (Fill up the blank)

(a) Unitary Elastic Supply

(b) Perfectly Elastic Supply

(c) Perfectly Inelastic Supply

(d) Perfectly Elastic Demand

Answer:

(c) Perfectly Inelastic Supply

Question 5.

Distinguish between positive economics and normative economics, with suitable examples.

Answer:

| Positive Economics | Normative Economics |

| 1. A branch of economics based on data and facts is positive economics.

2. It can be verified with original data. 3. It clearly describes economic issue. 4. E.g. western Railway has eaamed ₹ 517.41 crores by Selling scrap material in 2018-19 |

A branch of economic based on values, opinions and judgment is normative economics.

It cannot be verified with original data. It provides solution for the economic issue, based on value. E.g. the government should promote social safety nets to take care of the poor population. |

Question 6.

Explain the law of diminishing marginal utility, with the help of a hypothetical schedule.

OR

Elaborate the law of demand, with the help of a hypothetical schedule.

Answer:

According to the law of diminishing utility, as more and more units of commodity are consumed, the extra utility that we derive from it goes on declining. Total utility will continue to rise till the point of consumption when the marginal utility becomes zero. After this point, MU becomes negative which means now the good begins to harm consumer.

Assumption of Law of Disminishing Marginal Utility

- Utility can be measured in numeric terms.

- The consumption takes place in the stipulated time period (in continuation).

- All the consumers are assumed to be rational.

- Marginal utility of rupee is assumed to be constant.

Units consumed MU (in utils) TU (in utils)

1 12 12 2 9 21 3 5 26 4 0 26 5 (-)2 24

The schedule indicates that as more and more units of commodity are consumed, the marginal utility derived from the consumption of each additional unit of the commodity tends to fall. With the consumption of successive units the marginal utility becomes zero and consequently become negative. The MU become zero at the consumption of 4th unit and become negative at the consumption of 5th unit.

OR

The law of demand explains the inverse relationship between the price and quantity de-manded of a commodity. According to this law, ‘other things remaining constant’ (cetris peribus), price and quantity demanded of a commodity move in the opposite direction. When the price of the commodity increases, the quantity demanded falls and when the price decreases, the quantity demanded increases, provided factors other than price remain constant. More units of a commodity are purchased at a lower price because of a substitution effect and income effect.

Following are the assumptions of law of demand :

(a) No change in consumer’s income.

(b) No change in the price of the related goods.

(c) No change in the consumer’s taste, preferences and fashion.

(d) No expectation of change in the future prices of the goods.

(e) No change in the population.

Demand schedule

| Price of sugar (₹ per kg) | 20 | 40 | 50 | 70 |

| Quantity | 100 | 75 | 60 | 40 |

The demand schedule shows that the consumer will demand more sugar at lower price, other things being constant. When the price of sugar is ₹ 20 per kg the quantity demanded will be 100 kg but when price increase to ₹ 40 the demand decreases to 75 kg and 50 Kg so on. This shows that the price and demand are inversely related.

Question 7.

The market for a good is in equilibrium. How would an increase in an input price affect the equilibrium price and equilibrium quantity, keeping other factors constant ? Explain using a diagram.

Answer:

Input price refers to the money paid to the factors of production in return of their productive services. As the input price rises, the cost of production also rises and produc-tion levels falls. This leads to leftward shift in supply curve.

This leads to excess demand in the market. It leads to competition among buyers. Due to this, the price starts rising. As the price rises, demand contracts and supply expands. This will continue till there is no more excess demand.

Finally equilibrium prices rises from \(P_1\) to \(P_2\) and equilibrium quantity falls from \(Q_1\) to \(Q_2\)

Question 8.

(a) The coefficient of price elasticity of demand for Good X is (-) 0-2 . If there is a 5% increase in the price of the good, by what percentage will the quantity demanded for the good fall?

(b) Arrange the following coefficient of price elasticity of demand in ascending order : (-) 3.1, (-) 0.2, (-) 1.1

OR

How would the demand for a commodity be affected by a change in “tastes and preferences” of the consumers in favour of the commodity? Explain using a diagram.

Answer:

(a)

Percentage change in Quantity demanded = -1% Elasticity of demand is unitary elastic and the percentage fall in quantity demanded is 1%

(b) Ascending order (-) 0.2, (-)1.1, (-)3.1.

OR

Taste and preference is one of the factors affecting individual demand. If the consumers in the market have started liking a particular commodity, the demand for that commodity will increase. On the other hand, if there is a disliking for a particular commodity or preference for a commodity is falling, demand will decrease.

So change in taste and preference of the commodity in the favour of the other commodity, will shift the demand curve towards right from DD to \(D_1\) \(D_1\).

Question 9.

Which of the following statements are true or false ? Give valid reasons in support of your answer. ‘

(a) Average cost curve cuts Average variable cost curve, at its minimum level.

(b) Average product curve and Marginal product curve are ‘U-shaped’ curves.

(c) Under all market conditions, Average revenue and Marginal revenue are equal to each other.

(d) Total cost and Total variable cost curve are parallel curve to each other.

OR

Explain a firm’s equilibrium under perfect competition, using a hypothetical schedule.

Answer:

(a) False-Average cost and Average variable cost curves are U shaped curve. The vertical gap between Average cost and Average variable cost curves represent Average fixed cost. As we know with the increase in the output the vertical gap between Average cost and Average variable cost curves continuously decrease but never intersect.

(b) False, Average product curve and marginal product curve both rises and then tend to fall. Thus, the two curves are inverted ‘U’ shaped curve.

(c) False, only under perfect competition, AR and MR are equal to each other. Under Monopoly and monopolistic market, AR is greater than MR.

(d) True, TC and TVC curves are parallel to each other because the vertical distance between the two curves is TFC which is constant at all levels of output.

OR

In a perfectly competitive market, a very large number of firms produce a homogeneous (or identical) product and sell it to a very large number of buyers at a fixed price. Not a single buyer or seller can influence the market price. They are price taker. There is free entry or exit of firms in this form of market. Of course, en-try can take place only in the long-run. Here we assume that all firms in the industry are working under identical cost conditions. Iden-tical cost conditions for the firms mean that Average Cost (AC) and Marginal Cost (MC) curves are indentical for all firms in the in-dustry. In economics, short-run refers to that time period in which a firm can’t alter its fixed factors and the size of the plant. The firm can change its output by changing variable factors of production. Both in the short-run and long- run, firm’s objective is to maximize profit. The profit is given by the difference between Total Revenue (TR) and Total Cost (TC) i.e. profit = TR – TC. Now, profit maximising output quan-tity is reached when two conditions are satis-fied.

(a) MR = MC

(b) Rate of change in MR < Rate of change in MC

In a perfectly competitive market P = AR = MR = constant. So, the profit maximising condition in a perfectly competitive market boil down to

(a) P = MC (or SMC)

(b) MC (or SMC) curve must be positively sloped

This can be clear with the help of a table given below :

Five Situations of Short-Run Equilibrium under

Question 10.

Explain the meaning of the following features of the Oligopoly Market :

(a) Non-Price Competition

(b) Few Sellers

Answer:

(a) Non-price Competition: Oligopoly firm not only competes through price but also on the basis of non-price competition. Product variation and advertisement are the two main form of non price competition as they fear price war. Normally, the oligopoly firms do not respond to a rise in price by the rivals. However/they have to respond if a rival firm reduces the price of the product.

Implication : This results in price rigidity in the market.

(b) Few Sellers: Under Oligopoly, there are only few firms, producing a commodity. The product can be homogeneous or differentiated. These firms can influence the price and output by their actions.

Each firm produces significant portion of total output. There exists competition among different firms and each firm try to manipulate both price and volume of production. The number of buyer are large.

Implications: The number of firms is so small that an action by any firm is likely to affect the other firm. So every firm keeps a close watch on the actions of each other.

Question 11.

(a) What is meant by increasing retruns to a variable factor?

(b) Discuss breifly, any two reasons for the decreasing returns to a variable factor.

Answer:

(a) In short period, when other factors of production remains constant, if the proportionate change in Total Product is greater than the proportionate change in units of variable factor. If marginal product increases with the increase in units of a variable factors, then it is known as law of increasing returns to a variable factor.

(b) Causes of Decreasing Returns to Variable Factor :

(i) Decrease in level of efficiency : If we increase the units of variable factors too much with fixed factors of production (after optimum combination), then the factor proportion becomes more and more worse. Due to that, efficiency of both the factors decreases (because we are moving away from ideal combination). That’s why AP and MP both decrease. Due to that AC and MC both increases

(ii) Imperfect substitute : At the point of optimum combination of means of production average and marginal productivity can be increased by substituting fixed factor (because at this point fixed factor is completely utilized). But the factors of production are not perfect substitutes, therefore it is not possible to replace fixed factor with other factor and that’s why, if we have to increase the output at optimum combination then we have to increase the units of variable factor with the same units of fixed factors. As a result there will be over utilization of fixed factor, so AP and MP both decreases and AC and MC both increases. So ultimately decreasing return will apply.

Question 12.

Explain the following conditions :

(a) Movement along the same indifference curve.

(b) Shift from a lower to a higher indifference curve.

OR

Explain the law of Equi-Marginal Utility.

Answer:

(a) Movement along the same indifference curve : All the points along with the same indifference curve represents all those combination of two commodities which provides the same level of satisfaction to the consumer. Level of satisfaction remains constant whether we move upward or downward along the same indifference curve. In order to increase the consumption of one commodity the consumer has to sacrifice the consumption of the other “and he moves up and down on the same indifference curve.

In the present diagram, combination A (OX + OY) provides the satisfaction equal to combination \(B (OX_1 + OY_1)\).

(b) Shift from lower to a higher indifference curve : Curves nearer to origin represent lower level of satisfaction and curves which are away from origin represent higher level of satisfaction. It means as we move away from origin, level of satisfaction continuously increases.

In the present diagram \(IC_2\) represent higher level of satisfaction in comparison to \(IC_1\) and in the same way \(IC_3\) represent satisfaction more than \(IC_1\) and \(IC_2\) .

So if there are three indifferent curves in a single diagram then they will represent three different levels of satisfaction.

OR

Law of Equi-marginal utility states that a consumer allocates his expenditure on various commodities in such a manner that the utility derived from each additional unit of the rupee spent on each of the commodities is equal.

The ratio of the MU to price of X must be equal to the ratio of MU and price of Y.

\(MUx\over Px\)=\(MUy\over Py\)=……………=\(MUn\over Pn\)

This is known as a law of equi-marginal utility. It means the equality of the MU of the last rupee spent on each good. If \(Mu_x \over P_x\) is greater than \(M_y\over P_y\), it means that MU from the last rupee spent on good X is greater than MU of the last rupee spent on good Y. This induces the consumer to transfer the expenditure from Y to X. The consumption of X rises and \(MU_x\) falls, and MU of Y rises. This act continues till \(MUx\over Px\) and \(MUy\over Py\) are equal.

Assumptions of Law of Equi Marginal Utility

1. Utility can be measured in numeric terms.

2. The consumption takes place in the stipulated time period (in continuation).

3. All the consumers are assumed to be rational.

4. Marginal utility of rupee is assumed to be constant.

For e.g.: A consumer consumers 2 commodities X and Y for ₹ 3/unit and ₹ 2/unit respectively. It is assumed that \(MU_R\) = ₹ 2

| Units | MUx | MUy | MUx/Px | MUy/Py |

| 1 | 18 | 16 | 6 | 8 |

| 2 | 15 | 12 | 5 | 6 |

| 3 | 9 | 8 | 3 | 4 |

| 4 | 6 | 4 | 2 | 2 |

| 5 | 3 | 1 | 1 | 0.5 |

Section B

(MACROECONOMICS)

Question 13.

Primary deficit in a government budget will be zero, when ………….. (Choose the correct alternative).

(a) Revenue deficit is zero

(b) Net interest payments are zero

(c) Fiscal deficit is zero

(d) Fiscal deficit is equal to interest payment.

Answer:

(d) Fiscal deficit is equal to interest payment.

Question 14.

In order to encourage investment in the economy, the Central Bank may …………… (Choose the correct alternative)

(a) Reduce Cash Reserve Ratio

(b) Increase Cash Reserve Ratio

(c) Sell Government securities in open market

(d) Increase Bank Rate

Answer:

(a) Reduce Cash Reserve ratio.

Question 15.

What do you mean by a direct tax?

OR ‘

What do you mean by an indirect tax?

Answer:

Direct tax refers to a compulsory payment to the government whose impact and incidence falls on same person. It is progressive in nature. Example-Income tax and Property tax.

OR

Indirect tax refers to a compulsory payment to the government whose impact and incidence falls on different persons. It is regressive in nature. Example- VAT, custom duty.

Question 16.

Define ‘money multiplier’.

Answer:

When the primary cash deposits in the banking system leads to multiple expansion in the total deposits, it is called as money multiplier. It is inversely related to legal reserve ratio.

Question 17.

Calculate change in final income, if Marginal Propensity to Consume (MPC) is 0 8 and change in initial invesment is ₹ 1,000 crores.

Answer:

MPC = 0.8 and change in initial investment = ₹ 1000 crores

Change in income = ₹ 5000 crores.

Question 18.

State the impact of “Excess Demand” under the Keynesian theory on employment, in an economy.

OR

State the meaning of the following :

(a) Ex-Ante Savings

(b) Full Employment

(c) Autonomous Consumption

Answer:

Excess demand is not a desired situation because it does not lead to any increase in level of aggregate supply as the economy is already working at full employment level. Excess demand has the following effect on output, employment and general price level.

(i) Effect on Output: Excess demand does not effect the level of output because economy is already working at full employment level and there is no ideal capacity in the economy.

(ii) Effect on Employment : There will be no change in the level of employment as the economy is already operating at full employment equilibrium and there is no involuntary unemployment.

(iii) Effect on General Price Level : Excess demand leads to rise in the general price level (known as inflation) as aggregate demand is more than aggregate supply.

OR

(a) Ex-ante saving : The saving which the firms or entrepreneur desire to make at different levels of income in an economy during a period is called ex-ante (planned savings).

(b) Full employment : Full employment refers to the situation when all the workers who are willing and able to work at prevailing wage rate are actually employed and there is no involuntary unemployment

(c) Autonomous consumption : When income is zero consumption is not zero because consumption can never be zero even at zero level of income, there are some basic needs which need to be fulfilled even at zero level of income and to fulfill those basic needs we use past savings. This consumption at zero level of income is termed as ‘Autonomous consumption’ and is denoted as C .

Question 19.

Classify the following statement as revenue receipts or capital receipts. Give valid reasons in support of your answer.

(a) Financial help from a multinational corporation for victims in a food affected area.

(b) Sale of shares of a Public Sector Undertaking (PSU) to a private company, Y Ltd.

(c) Dividends paid to the Government by the State Bank of India.

(d) Borrowings from International Monetary Fund (IMF).

Answer:

(a) Financial help from a multinational company is a aid to the government so it is a revenue receipt as it does not create any liability and reduction in assets.

(b) It is a capital receipt. As sale of shares will reduce the assets of the PSU.

(c) Dividends paid to the government is a revenue receipt as it neither creates any liability nor reduces the assets.

(d) It is a capital receipt. It increases the liability of the government.

Question 20.

“Higher Gross Domestic Product (GDP) means greater per capita availability of goods in the economy.” Do you agree with the given statement? Give valid reason in support of your answer.

OR

Explain the meaning of Real Gross Domestic Product and Nominal Gross Domestic Product, using a numerical example.

Answer:

I do not agree with the statement that “Higher gross domestic product (GDP) means greater per capita availability of goods in economy” as higher GDP does not mean high per head availability of goods and services.

(i) It depends upon the population of the country. If GDP is higher but population is • equally high then per head availability of goods and services will be low.

(ii) It also depends on the fact that whether the income is equally distributed or unequally distributed. If income is equally distributed then share of goods and services for each individual will be equal but if it is unequally distributed, the rich will take more share in comparison to a poor.

OR

Real GDP refers to the money value of all the final goods and services calculated at a base year price produced within the domestic territory in a given time period.

Nominal GDP refers to the money value of all the final goods and services calculated at a current year prices produced within the domestic territory in a given time period.

|

Commodities |

Quantity in 2018 | Prices in 2011 | Prices in 2018 | Real GDP |

Nominal GDP |

| A | TO | 5 | 10 | 50 | 100 |

| B | 15 | 7 | 10 | 105 | 150 |

| C | 20 | 10 | 15 | 200 | 300 |

| D | 5 | 12 | 15 | 60 | 75 |

| Total | 415 | 725 |

In the above table real GDP is ₹ 415 for the year 2018 while nominal GDP is ₹ 725 for the same year. Such a difference in GDP is due to increase in prices from base year to current year.

Therefore, Real GDP is always considered as true indicator of economic growth.

Question 21.

Distinguish between ‘Qualitative and Quantitative tools’ of credit control as may be used by a Central Bank.

Answer:

| Quantitative Tools of Credit Control | Quatitative Tools of Credit Control |

| 1. It regulates the volume of credit. | It regulates the flow of credit. |

| 2. These are the general tools to control the credit. | These are the specific tools to control the credit. |

| 3. It includes – Bank rate, CRR, SLR, open market operations, etc. | It includes – margin requirements, moral suasion etc. |

Question 22.

(a) Define “Trade Surplus” and “Trade Deficit”.

(b) Discuss breifly the concept of managed floating system of foreign exchange rate determination.

Answer:

(a) Trade surplus refers to the excess of exports of goods over the imports of goods. Trade deficit refers to the excess of import of goods over the export of goods.

(b) Managed floating exchange rate system- It is a system in which the foreign exchange rate is determined by the market forces and central bank influences the exchange rate through intervention in the foreign exchange market. Central bank interferes to restrict the fluctuations in the exchange rate within limits. For this central bank maintains the reserve of foreign exchange to ensure that the exchange rate stays within the targeted value. It is also known as “Dirty floating”.

Question 23.

Discuss the adjustment mechanism in the following situations :

(a) Aggregate demand is lesser than Aggregate Supply.

(b) Ex-Ante Investments are greater than Ex- Ante Savings.

Answer:

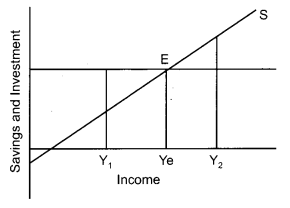

(a) At the income level above the equilibrium, the planned aggregate demand (AD) is less than the aggregate supply (AS). This implies that there is an excess availability of goods and services in an economy. This surplus in goods is added to the inventory stock of goods. The rise in the inventories above a desired level reduces the production which leads to the decrease in income and employment in the economy. This process continues till AD gets equal to AS.

(b) Adjustment Mechanism when planned in-vestment is greater than planned savings :

(i) When planned (ex-ante) saving is more than planned investment. Suppose firms plan to invest ₹ 20,000 crores but households plan to save ₹ 25,000 crores, it shows consumption expenditure has decreased. Consequently, AD falls short of AS. Due to excess supply there will be stock piling of unsold goods, i.e., unintended unplanned inventories will accumulate. At this, the producers will cut down employment and produce less. National income will fall and as a result planned saving will start falling until it becomes equal to planned investment. It is at this point equilibrium level of income is determined.

(ii) When planned (ex-ante) saving is less than planned investment. Suppose producers plan to invest ₹ 20,000 crores but households plan to save ₹ 15,000 crores, then AD (or consumption expenditure) is more than AS. Production will have to be increased to meet the excess demand. Consequently national income will increase leading to rise in saving until saving becomes equal to investment. It is here that equilibrium level of income is established because what the savers intend to save becomes equal to what the investors intend to invest. If planned saving and planned investment are equal, then output, income, employment and price level will be constant.

Question 24.

Define the following :

(a) Value Addition

(b) Gross Domestic Product

(c) Flow Variables

(d) Income property and entrepreneurship

OR

Given the Following data, find the value of “Gross Domestic Capital Formation” and “Operating Surplus”.

Answer:

(a) Value addition refers to the produced within the domestic territory of a country during a accounting year.

(b) Gross domestic product refers to the money value of all the final goods and services produced within the domestic territory of country during a accounting year.

(c) Flow variables are the measurable variables that are measured over a period of time, e.g., National income.

(d) Income from property and entrepreneurship is also called the operating surplus which is the sum up of rent, royalty, interest and profits.

OR

Gross Domestic Capital Formation = (i) – {(iii) + vii + x} + vi – xii + iv

GDCF = 22,100 – {7,200 + 6,100 + 3,400} + 500 (-150) + 700

GDCF = ₹ 6750 crores

Operating Surplus = National income – wages and Salaries – mixed income of self employed – net factor income from abroad

= 22,100 – 12,000 – 4,800 – (-150)

= ₹ 5,450 crores

Class 12 Economics 2019 Set – II

Section – A

(MICRO ECONOMICS)

Question 6.

Differentiate between Microeconomics and Macroeconomics, with suitable examples.

Answer:

Question 8.

The market for a good is in equilibrium. Explain, using a diagram, how a decrease in input price would affect the equilibrium price and equilibrium quantity, keeping other factors constant.

Answer:

Input prices refer to the money paid for factors of production in return of their productive services. As the input price falls, the cost of production also falls and production level rises due to high profit margins. This leads to a rightward shift in the supply curve in figure given below.

This condition leads to an excess supply in the market. It also leads to the competition among the sellers due to which the price of the product starts falling. As the price of the product falls, demand expands and supply contracts. This continues till there is no more excess supply. Finally, equilibrium prices fall from P1 to P2 and equilibrium quantity rises from Q1 to Q2.

Question 10.

(a) Explain the meaning of the Trice Discrim-ination” feature under the monoply form of market.

(b) Compare the nature of demand curves under monopoly and monopolistic competition.

Answer:

(a) The art of selling the same product at different prices to different buyers is known as price discrimination. When the monopolists adopt the policy of price discrimination, it is known as discriminating monopoly. Price discrimination may take place under the following situations :

- When elasticity of demand for a product is different in different markets, the monopolists will charge higher when demand is inelastic and lower when demand is elastic.

- When the buyers of one part of the market do not know the prices are lower in other part of the market.

- When Government permits price discrimination.

(b) Demand curve under monopolistic competition and monopoly

Both the markets face downward sloping demand curves. However, demand curve under monopolistic competition is more elastic as compared to the demand curve under monopoly. This happens because differentiated products under monopolistic competition are close substitutes of one another whereas there are no close substitutes in case of monopoly.

Section – B

(MACROECONOMICS)

Question 17.

Estimate the change in initital investment if Marginal Propensity to Save (MPS) is 010 and change in final income is ₹ 15,000 crores.

Answer:

MPS = 0.10

Change in Income = ₹ 15,000 crore

Multiplier (K) = 1/MPS = 1/0.10 = 10

K = Change in income AY/ change in investment AI.

10 = 15,000 change in investment

Change in investment = ₹ 1500 crores.

Question 19.

Discuss briefly the following functions of a Central Bank :

(i) Banker’s bank

(ii) Lender of last resort

Answer:

(i) Banker’s Bank: As a banker to the banks, the Central Bank holds surplus cash reserves of commercial banks. It also lends to commercial banks when they are in needs of funds – Central Bank also provides a large number of routine banking functions to the commercial banks. It also act as a supervisor and regulator the banking system.

OR

(ii) Lender of last resort: In case the commercial bank, fails to meet its financial requirement from other sources, it can approach to the Central Bank as a last resort for loans and advances. Central Bank helps these banks by discounting approved securities and bills of exchange or providing loans against their securities. By providing temporary financial help, Central Bank saves the financial structure of the country from collapsing. The direct lending to the commercial bank by the Central Bank is referred to as Tender of the last resort, function of the Central Bank’.

Question 22.

(a) Distinguish between appreciation of home currency and depreciation of home currency.

(b) What is a meant by “current account surplus”?

(c) State any one source of supply of foreign currency for a country.

Answer:

(a)

| Appreciation of home currency | Depreciation of home currency |

| 1. It refers to the rise in the value of domestic currency with respect to foreign currency. | 1. It refers to the fall in the value of domestic currency with respect to foreign currency. |

| 2. It leads to fall in exports and rise in imports. | 2. It leads to fall in imports and rise in exports. |

| 3. It is due to fall in demand or rise in the supply of foreign currency. | 3. It is due to rise in demand or fall in the supply of foreign currency. |

| 4. It corrects the situation of BOP (Balance of payment) surplus automatically. | 4. It corrects the situation of BOP (Balance of Payments, deficit automatically. |

(b) Current Account in BOP is in suplus when the total receipts on account of total export of goods and services are greater than payments on account of import of goods and services.

(c) Export of goods and services is one of the source of supply of foreign currency.

Class 12 Economics 2019 Set – III

Question 5.

Discuss briefly the concept of normative economics, with suitable example.

Answer:

Normative economics focuses on the ideological, opinion-oriented, prescriptive value of judgements and “what should be” statement aimed towards economic development, investment project, and scenarios. Its goal is to summarize people’s desirability (or the lack thereof) to various economic developments, situations, and programs by asking or quoting what should happen or what ought to be. ‘ Normative economics is subjective and the value -based, originating from personal perspectives, feelings, or opinions involved in the decision making process. Normative economics statements are rigid and prescriptive in nature. They often sound political or authoritarian, which is why this economic branch is also called “what should be” or “what ought to be” economics.

An example of a normative economic statement is : “The government should provide basic healthcare to all citizens.” As you can deduce from this statement, it is value-based, rooted in personal perspective, and satisfies the requirement of what “should” be.

Question 9.

The market for a good is in equilibrium. Explain, using a diagram, how an improvement in technology for producing the goods would effect the equilibrium price and equilibrium quantity, keeping other factors constant.

Answer:

Updated technology helps to increase the production in less time and cost. Due to this, the expected profit margin of a producer increases and he produces more output. Hence, the supply of the commodity rises and the supply curve shifts towards right.

This leads to an excess supply in the market. It increases the competition among the sellers. Due to this, the prices starts falling. As the price falls, demand expands and supply contracts. This continues till there is more excess supply in the market.

Finally, equilibrium prices falls from P1 to P2 and equilibrium quantity rises from Q1 to Q2.

Question 11.

(a) “A firm under perfect competition is a price taker, whereas a firm under monopoly is a price maker”. Defend or refute the given statement with valid reasons.

(b) What is meant by “product differentiation”? Explain with example.

Answer:

(a)Thegivenstatmentis true.Equilibrium price in a perfect market is determined by the industry not by a individual firm. The price is determined by the intersection of demand and supply of an industry which is accepted by all the firms, thus, an individual firm is a price taker while industry is a price maker in this case. Price-Determination under Perfect Competition

On the other hand, in monopoly market, the firm is a price maker as it has full control over supply of its commodity because :

- There is no competition in the market

- There are barriers in the entry of new firms in the monopoly market.

Therefore, monopolist can influence the market price by varying its supply. It can increase the price by supplying less and reduce the price by supplying more.

(b) Product Differentiation: Under this market products of different firms are not homogeneous but are close substitutes of each other. Products are differentiated from one another in terms of brand name, colour, shape, quality, type etc. Due to product differentiation, firms here enjoy control over prices and have its own price policy.

For example, there are number of toothpastes available in the market like Colgate, Closeup, Pepsodent etc.

Implications: Buyers of the products differentiate between the same kind of products produced by different firms. Therefore, they are also ready to pay different prices for the same product produced by different firms. This gives power to the firm to influence price of the product.

Question 18.

Estimate the change in final income if Marginal Propensity to Consume (MPC) is 0-75 and change in initital investment is ₹ 2,000 crores.

Answer:

MPC = 0.75

Change in investment = ₹ 2000

Change in income = ₹ 8000 crore

Question 20.

Discuss briefly the “credit controller” function of Central Bank.

Answer:

Central Bank as a credit controller:

It is the most important function of Central Bank. By controlling the credit effectively, Central Bank establishes stability not only in the internal price level but also in the foreign exchange rate and full employment.

This function helps to meet some definite objectives such as price stability, economic growth, exchange rate stability etc. These objectives are achieved by regulating money supply. It includes two types of measures :

(a) Quantitative measures: It includes Bank rate, Repo rate, Open Market Operations (OMO), CRR, SLR etc.

(b) Qualitative measures: It includes moral suasion, margin requirement, direct actions etc.

Question 24.

(a) Distinguish between ‘Trade Deficit” and ‘Current Account Deficit’.

(b) Discuss breifly the concept of flexible exchange rate system of foreign exchange rate determination.

Answer:

(a)

| Trade Deficit | Current Account Deficit |

| 1. Trade deficit refers to the excess of import of goods over the export of goods. |

Current account deficit refers to the excess of current account payments over current account receipts. |

| 2. It is a narrower term. | It is a broader term. |

| 3. It does not include services and unilateral transfers. | It includes services and unilateral transfers. |

(b) Flexible exchange rate is a system where the value of one currency in terms of another is free to fluctuate and establish the equilibrium level through the forces of demand and supply. It can be better understood with the following merits and demerits of the flexible exchange rate :

(i) Merits :

- No need to maintain reserves of foreign currency.

- Automatic adjustment in balance of payments (BOP) is possible.

- No dependence on external sources.

(ii) Demerits :

- It creates unstable conditions and uncertainty.

- Increased speculation with a destabilizing effect.

- Gives rise to inflation in the economy.